Construction Resources: Certificate of Insurance

Learn more about how to read your insurance certificate and what each sections means with this handy construction contracts resource guide.

May 5, 2016

|

Contractor

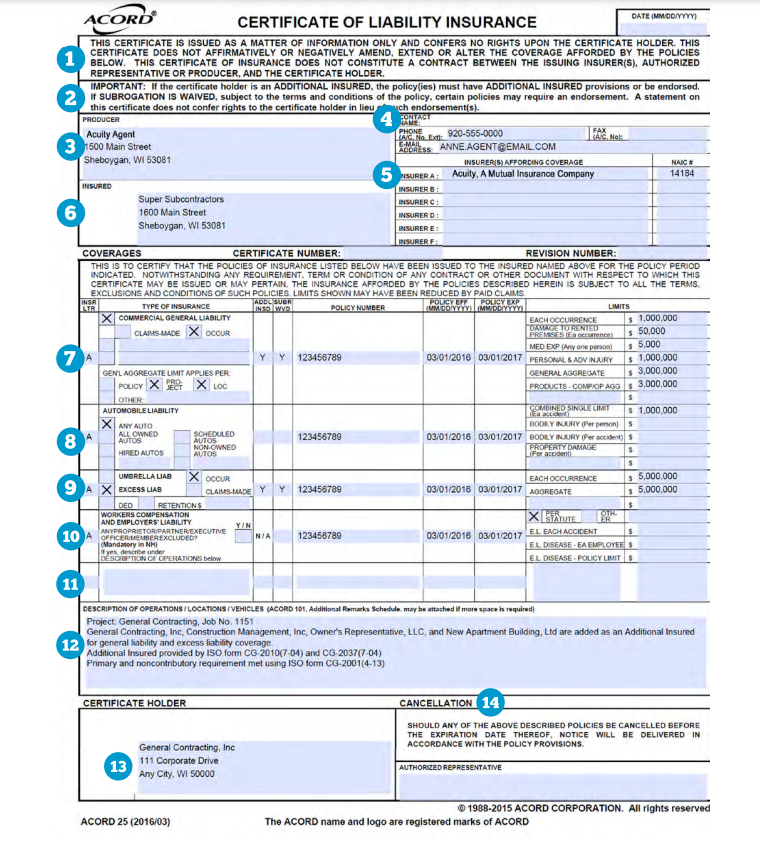

Reading a certificate of liability insurance isn't always the easiest thing to do. Our construction experts help break down the certificate and highlight key areas of the form that provides an in-depth look at each field.

Please refer to the sample Certificate of Insurance above.

- A certificate of insurance is a “snapshot” of the coverages provided at the time the certificate is issued. Only the policy forms and endorsements confer coverage.

- Additional insured and waiver of subrogation are common construction contract insurance requirements. The policy must be reviewed by your insurance agent to be sure the proper endorsements are attached.

- PRODUCER - Insurance term for the insurance agent who sold the insurance policy.

- AGENT CONTACT INFORMATION - Producer/agent contact information.

- INSURER(S) AFFORDING COVERAGE - Indicates which insurance company is providing coverage. It is possible to have a different insurance company for each type of coverage listed.

- INSURED - The person or organization who purchased the insurance and has the policy in their name.

- COMMERCIAL GENERAL LIABILITY

- A type of insurance that pays for damages arising out of the insured’s premises, operations, products and completed operations, as well as personal injury or an injury brought about by a business advertising its goods or services.

- The coverage provided by Acuity is an “occurrence”- type policy, which means that the policy responds to accidental events that occur during the policy period regardless of when the claim is made.

- Various limits determine the most we will pay for a loss. They include:

- Each Occurrence. The most we will pay in the event of one occurrence for bodily injury and property damage that arise out of ongoing operations by our insured.

- Damage to Rented Premises. The most we will pay for damage to a rented premises.

- Personal and Advertising Injury. The most we will pay for a personal injury or advertising injury offense.

- Products - Completed Operations Aggregate. The most we will pay for the sum of all damages arising out of a product or an operation that has been completed by our insured.

- General Aggregate. The most we will pay for the sum of all medical expenses, bodily injury, and property damage that arise out of premises liability or ongoing operations by our insured, as well as personal and advertising injury.

- Medical Expense. The most we will pay for medical expenses because of bodily injury sustained by any one person, even if the insured is not at fault.

- AUTO LIABILITY

- The limits are typically shown as combined single limit, which means that all bodily injury and property damage are subject to that limit. It is also possible to have a limit for bodily injury per person, a maximum bodily injury limit per accident, and a property damage per accident limit.

- Although “any auto” is a popular coverage selection, a combination of all owned, hired, and non- owned autos provides equivalent coverage.

- EXCESS LIABILITY (Higher Liability Limits)

- This coverage pays above (or excess of) general liability, auto liability, and employers’ liability coverages.

- Excess liability is provided using an “occurrence” coverage trigger.

- Coverage uses both each occurrence and aggregate limits.

- WORKERS’ COMPENSATION

- Workers’ compensation includes employers’ liability coverage.

- Typical employers’ liability limits are:

- $100,000 per occurrence for bodily injury,

- $100,000 per employee for bodily injury by disease, and

- $500,000 limit for bodily injury by disease.

- Increased limits may be purchased.

- LIST OTHER LIABILITY COVERAGES HERE - Other liability insurance often includes professional liability.

- DESCRIPTION

- Special instructions or terms of coverage, such as identification of the project, reference to a job number, or other identification of the operations with respect to which the certificate is issued.

- Exclusions added by endorsement or waivers of subrogation may also be listed.

- Individuals or corporations that are required to have additional insured status are usually identified in this box as well. If a contract specifies a particular additional insured form be used, it should also be identified when referencing the additional insured.

- This is an example of how these may be shown.

- CERTIFICATE HOLDER - The person or organization that requested the snapshot of insurance coverage.

- CANCELLATION - If a notice of cancellation is required, Acuity will attach endorsement IL-7002 to provide that notice (other than non-payment of premium).

We have created an easy to print version of this guide as well that you can keep with you as you navigate the contracts for your construcion business.

An insurance company that cares about you and insuring the things you wish to be insured.

Get a Quote> Find an Agent>