Top 5 Reasons to Write Truckers With Acuity

“We want to insure your trucking business,” says Melissa Winter, President. “Acuity is committed to supporting truckers and delivering products and services that provide protection they can count on.”

“We know that truckers have more choices in today’s increasingly competitive insurance marketplace, but there’s a reason why we protect nearly 50,000 trucks on the road today,” says Neil Argall, Vice President – Commercial Insurance.

Here are the top 5 reasons to write truckers with Acuity:

1. Market Stability

Acuity is a consistent partner for you in trucking, unlike other companies that keep you guessing. We insure everything from tractor-trailers to vans and owner-operators to large fleets.

“We’re not a drive-by carrier that pistons in and out of the trucking marketplace. You can depend on Acuity to be in it for the long haul,” says Wally Waldhart, Vice President – Distribution.

We are also a strong advocate for the trucking industry, including through our longstanding support of regional and national trucking associations.

2. Expanding Appetite

Acuity continues to grow our trucking eligibility to make it even easier to write business with us. Recent expansions include milk haulers, double trailers, and workers’ compensation for livestock haulers.

Want to learn more about Acuity’s trucking eligibility? Check out our Trucker Guidelines.

3. Unparalleled Resources

“We have our finger on the pulse of the trucking industry and offer resources and content to serve you and our trucking customers,” says Joel Katsma, Vice President – Market Strategy and Communications. Key resources include:

- An extensive array of safety materials, including our Motor Carrier Toolbox, quarterly Trucker Focus newsletter, OSHA and FMCSA compliance support, streaming videos, and more.

- Our on-staff trucking consultant, Cliff Johnson.

- A dedicated trucking team focused on delivering products and services truckers need.

- Loss control reps with hands-on trucking experience who are knowledgeable in CSA scores and trends, specializing in risk management and consulting accounts on improving safety.

- Expanding industry partnerships and programs, including our new telematics discount program.

4. Comprehensive Coverage

Highlights of Acuity’s trucking-focused coverage include:

- Many built-in advantages, including auto glass repair, ELDs, and towing after a loss.

- A truckload of available options, including miscellaneous equipment, business income and extra expense, and rental reimbursement.

- Our unique Truckers Enhancements option adds even more protection.

Check out our Built-In Advantages and Enhancements brochure to learn more! Acuity can also write all lines of insurance on one policy with one bill, and we offer many payment options.

5. World-Class Claims Service

When we say our service is world-class, we mean it. Acuity provides:

- A 97% positive customer experience.

- Same-day contact and a single point of contact throughout the life of a claim.

- Real-time claim information.

- Dedicated field claims professionals across our operating territory.

- Heavy equipment and trucking claim specialization.

- Aggressive legal defense, partnering with trucking-focused legal counsel to protect policyholders against lawsuit abuse.

Driven to Protect

In short, Acuity is driven to protect your trucking accounts! With unparalleled financial strength and A+ ratings from both S&P and AM Best, we have what it takes to fulfill our promise to policyholders.

Did you know?

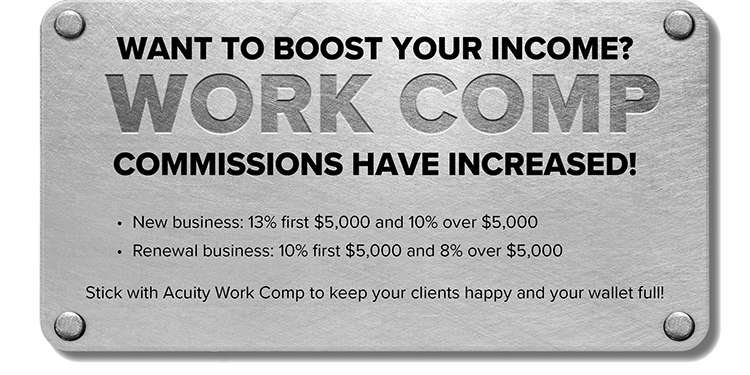

We want work comp for truckers!

An insurance company that cares about you and insuring the things you wish to be insured.

Get a Quote> Find an Agent>