Service Line Coverage: What is it & who needs it?

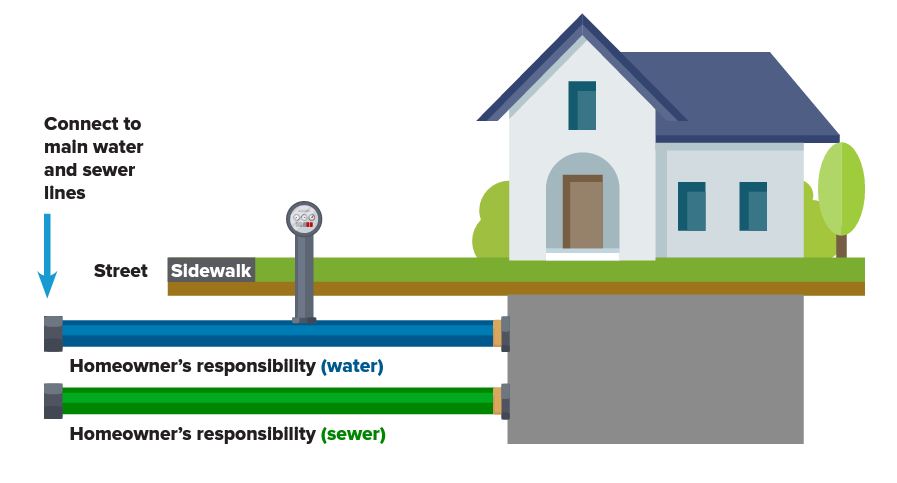

Did you know that as a homeowner, you are responsible for the underground piping and wiring that runs from the street to your home? If not, that’s OK! Service line coverage is often overlooked. That’s why we want to share some commonly asked questions about service line coverage with you.

Roll up your sleeves—we are about to get insurancy.

What is service line coverage?

Service line coverage pays for damage to underground piping and lines in your yard that provide services to your home. It covers things like sewer, water, electrical, natural gas, cable TV, and internet. We know all these provide crucial services.

What does service line insurance cover?

Acuity’s endorsement covers damage to service lines resulting from:

-

Tree roots or other plants growing into your service line

- Freezing

- Wear and tear or rust

- Weight of vehicles or equipment

- Animals, including insects or vermin

Why do you need service line coverage?

You can’t see what is going on underground. Just imagine what’s hiding under there—or not. That’s what service line coverage is for.

When it comes to costs, it’s not just the cost of repairing or replacing the damaged line that you need to think about. There are many situations you can’t control when it comes to excavating to get to the damaged line.

- What if a bunch of plants and trees were damaged in the excavation?

- What if you needed to dig up your patio?

- What if you couldn’t live in your home while the line was damaged and being repaired?

- Service line coverage provides financial help in these situations.

How does service line coverage work?

Here’s an example of when service line coverage would be used.

During a winter cold spell, a water pipe connecting to the primary public pipeline froze and ruptured. Excavation cost $3,950, a replacement water line cost $1,000, and replacement trees, shrubs, and lawn cost $1,450. The homeowner also needed three nights in a hotel before water was restored, costing $800.

Total costs: $7,200

Homeowner’s responsibility: $500 deductible

Acuity’s insurance payment: $6,700

Acuity's service line coverage

Service line coverage limits and deductibles.

Acuity offers a total coverage limit of $10,000 with a $500 deductible. There are no other limits or sub-limits to worry about.

Protect your finances in case your service lines need repair.

Our pricing for service line coverage is very competitive, starting at just $9 per year for homes less than 16 years old.

FAQs

Have questions? We have answers.

What kind of damage is not covered by service line coverage?

Not everything happening below ground is covered with service line coverage. It does not cover loss or damage to things like:

- Fuel tanks

- Water wells

- Wiring or piping to outdoor property, including light fixtures, electric fencing, sprinklers, and swimming pools

- Underground storm drainpipes or systems used to direct water away from the home

- Costs to clean up or remove pollutants, hazardous waste, or sewage

Is service line coverage required?

No, service line coverage is not required. This coverage is optional and may be added to a homeowners insurance policy for a charge.

What if I have a damaged service line and want to submit a claim?

You will be in great hands. Simply give us a call at 800.242.7666 or report your property claim online.

Learn more about Acuity’s claims process.

What insurance companies offer service line coverage?

While other insurance companies may offer service line coverage, some have separate sub-limits for things like temporary repairs, outdoor property, and additional living expense if the home is uninhabitable for a few days. Acuity includes these additional coverages, without sub-limits, as part of the $10,000 endorsement limit.